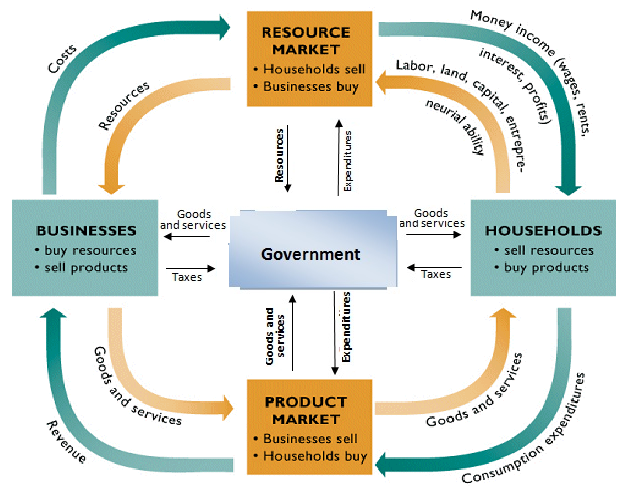

Circular flow model

- represents the transactions in an economy

- 4 Types: Traditional, mixed, capital, command

- Capital (free market, free enterprise):

- All goods and services flow in a clockwise direction

- Two markets: product market and factor market

- Product market; this is the place where goods and services are produced by businesses and are bought and sold to households

- Resource/Factor Market: this is the place where households sell resources and businesses buy resources.

3 Economic Factors

- Households: this is where you have a person or group of people that share their income

- Government

- Firm: organization that produces goods and services for sale.

Unit 2 Part 2 (1/27)

National Income Accounting: Economists collect statistics on production, income, investment, and savings.

Expenditure Approach: this is where we are adding up the market value of all domestic expenditures made on all final goods and services in a single year.

• C + Ig + G + Xn = GDP

Income Approach: we are adding all the income earned by households and firms in a single year.

• W + R + I + P + Statistical Adjustments

Wages, rents, interest, profit (proprietor's income)

• wages: compensation of employees or salary

• Rent: from tenants to landlords or from lease payments that corporations pay for the use of space

• Interest: money paid by private businesses to the suppliers of loans used to purchase capital

• Profit (corporate income taxes, dividends, undistributed corporate profits)

GDP (Gross Domestic Product): the total dollar value of all final goods and services produced within a country's borders within a given year.

Included in GDP:

C + Ig + G + Xn

Consumption: takes up 67% of the economy. Includes final goods and services.

Ig: gross private domestic investment

1) Factory Equipment Maintenance

2) New factory equipment

3) Construction of housing

4) Unsold inventory of products built in

a year.

G: Government Spending (military, school, etc)

Xn: Net Exports (Exports - Imports)

Not included in GDP:

1) used or secondhand goods

2) Intermediate Goods: goods and services that are purchased for resale or for further processing or manufacturing. (multiple counting error)

3) Non-Market Activities (volunteer work, babysitting, illegal drug sales, bartering, trading, underground activities, etc.)

4) Financial Transactions (stocks, bonds, real estate)

5) Gifts or transfer payments

• Public transferred payment is where recipients contribute nothing to the current production (social security, welfare payments, etc)

• Private transferred payments produces no output. It is simply transferring funds from one individual to another. (Scholarships, Christmas gifts)

6) foreign

Unit 2 Part 3 (1/28)

Budget: Government Purchases of Goods & Services + Government Transferred Payments - Government Tax & Fee Collections

- If # is positive, you have a budget deficit

- If # is negative, you have a budget surplus

NI (National Income): NDP - Indirect Business Taxes - Net Foreign Factor Income

OR GDP - Indirect Business Taxes - Depreciation - Net Foreign Factor Income

OR Compensation of Employees + Rental Income + Interest Income + Proprietor's Income + Corporate Profits

PI (Personal Income): NI - Social Security Contributions - Corporate Income Taxes - Undistributed Corporate Profits + Transfer Payments

DI (Disposable Income): PI - Personal Taxes

OR NI - Personal Household Taxes + Government Transfer Payments

NNP (Net National Product): GNP - Depreciation

NDP (Net Domestic Product): GDP - Depreciation

Unit 2 Part 3 (1/28)

Budget: Government Purchases of Goods & Services + Government Transferred Payments - Government Tax & Fee Collections

- If # is positive, you have a budget deficit

- If # is negative, you have a budget surplus

NI (National Income): NDP - Indirect Business Taxes - Net Foreign Factor Income

OR GDP - Indirect Business Taxes - Depreciation - Net Foreign Factor Income

OR Compensation of Employees + Rental Income + Interest Income + Proprietor's Income + Corporate Profits

PI (Personal Income): NI - Social Security Contributions - Corporate Income Taxes - Undistributed Corporate Profits + Transfer Payments

DI (Disposable Income): PI - Personal Taxes

OR NI - Personal Household Taxes + Government Transfer Payments

NNP (Net National Product): GNP - Depreciation

NDP (Net Domestic Product): GDP - Depreciation

GNP (Gross National Product): it is a measure of what its citizens produced and whether they produce these items and whether they produce these items within its borders

• GDP + Net Foreign Factor Income

• GDP + Net Foreign Factor Income

Nominal GDP: the value of output produced in current prices. It can increase from year to year if either output or price increases.

Real GDP: the value of output produced in base year or constant prices. It is adjusted for inflation. It can increase from year to year only if output increases.

Base Year Price x Quantity

Base year is given or is the earliest year.

REAL OR NOMINAL: Price x Quantity

Price Index: a measure of inflation by tracking changes in a market basket of goods compared with that in a base year

• (price of market basket of goods in current year) / (price of market basket of goods in base years) x 100

GDP Deflator: it is a price index used to adjust from nominal GDP to real GDP

- In the base year, GDP deflator is equal to 100. For years after the base year, GDP deflator is greater than 100. For years before the base year, GDP deflator is less than 100.

• (Nominal GDP) / (Real GDP) x 100

Inflation: (New GDP Deflator - Old GDP deflator) / Old GDP Deflator x 100

Unit 2 Part 4 (2/2)

I. Inflation: a rise in the general level of prices.

II. Measuring Inflation (Standard is 2-3%)

A) Inflation Rate: measures the percentage increase in the price level over time. Offers a key indicator of the economy's health.

a) Deflation: Decline in the general price level.

b) Disinflation: Occurs when the inflation rate declines. Price has raised, but not back to the original price.

B) Consumer Price Index (CPI): Measures inflation by tracking the yearly price of a fixed basket of consumer goods and services. Indicates changes in the price level and cost of living.

III. Solving Inflation Problems

A) Finding inflation rate using market basket data: (current year market basket value) - (base year market basket value) / (base year market basket value) x 100

B) Finding inflation rates using price indexes: (current year price index) - (base year price index) / (base year price index) x 100

C) Estimating inflation using the rule of 70: Rule of 70: used to calculate the number of years it will take for the price level to double at any given rate of inflation.

(Years needed to double inflation) = 70 / (annual inflation rate)

D) Determining Real Wages. (Real wages) = (nominal wages) / (price level) x 100

E) Finding Real Interest Rate: (Nominal Interest Rate) - (Inflation Premium)

a) Real Interest Rate: the cost of borrowing or lending money that is adjusted for inflation (expressed as a percentage)

b) Nominal Interest Rate: the unadjusted cost of borrowing lending money

IV. Causes of Inflation

A) Demand-Pull Inflation: caused by an excess of demand over output that pulls prices upward (ex. closer you are to the center of a concert, the higher the prices)

B) Cost-Push Inflation: caused by a rise in per unit production cost due to increasing resource cost (ex. Airplane costs rise because gas goes up)

V. Effects of Inflation

A) Unanticipated: unaware

B) Anticipated

Helped by Inflation: Borrowers. Debt will be repaid with cheaper dollars than those that were loaned out.

Hurt by Inflation: Fixed Income, Savers, lenders & creditors (when they get their money back, the money is worth less than what was borrowed)

Unit 2 Part 4 (2/3)

Unemployment: the percentage of people who do not have jobs that are in the labor force

Unemployment Rate: (# of unemployed) / (# of unemployed + # of employed) x 100

Ideal unemployment rate: 4-5%

Labor Force: the number of people in a country that are classified as either employed or unemployed

Not in the Labor Force:

1) Children

2) Military Personnel

3) Mentally Insane

4) Incarcerated People

5) Retirees

6) Stay at home parents

7) Full-Time Students

8) Discouraged Workers (those who look for a job but cannot find one)

Types of Unemployment

1) Frictional: people who are between jobs, usually because they choose new opportunities, new choices, new lifestyles, or perhaps new educational levels

2) Seasonal: waiting for the right season to go to work. Ex. Santa Claus, Construction Workers, Life Guards

3) Structural: technology changing, associated with lack of skills or a declining industry. Ex. NASA, typewriter technicians

4) Cyclical: Unemployment that occurs due to a swing in the economy. Associated with the business cycle. Trough or contractionary period

Full Employment: occurs when there is no cyclical unemployment present in the economy. 4-5 % Unemployed

• Natural Rate of Unemployment (NRU) 4-5%

• Economy producing at its full potential

Why is unemployment bad?

1) Not enough consumption (GDP)

2) Too much poverty

3) Too much government assistance

Why is unemployment good?

1) There is less pressure to raise wages

2) There is more workers available for future expansions

Okun's Law: every one percent of unemployment above the NRU causes a 2% decline in real GDP